*Updated as of 31 March 2025.

The Bill passed parliament on 25 November 2022.

The Treasury Laws Amendment (Electric Car Discount) Bill 2022, AKA the law treating Electric Vehicles purchased below the Luxury Car Tax threshold as FBT Exempt, has passed through Parliament. Not only is this a watershed moment for the uptake of EVs within Australia, but it is also a significant opportunity for employees in the market for a new car to increase their take home pay, and an equally considerable opportunity for employers to reduce their FBT liabilities.

Every so often a unique opportunity presents itself that seems too good to be true and in almost all instances, this is exactly the case. Therefore, if you were told you could have annual tax savings of up to five figures through a salary packaging arrangement, simply by opting to purchase an electric vehicle as an alternative to a petrol car, then you would probably think this is just another one of those too good to be true moments. Yet, with the passing of the Electric Car Discount Bill into law, this prospect is now a reality.

With the law now changed, electric and hydrogen vehicles costing less than the fuel-efficient Luxury Car Tax threshold (currently $91,387) are now FBT exempt.

Please note: The purchase of new or used plugin-Hybrid vehicles will be excluded from the Electric Vehicle discount bill from 1 April 2025. Any existing vehicle arrangements for eligible Plug-in-Hybrids will still be eligible for the FBT exemption for the duration of the existing lease arrangement.

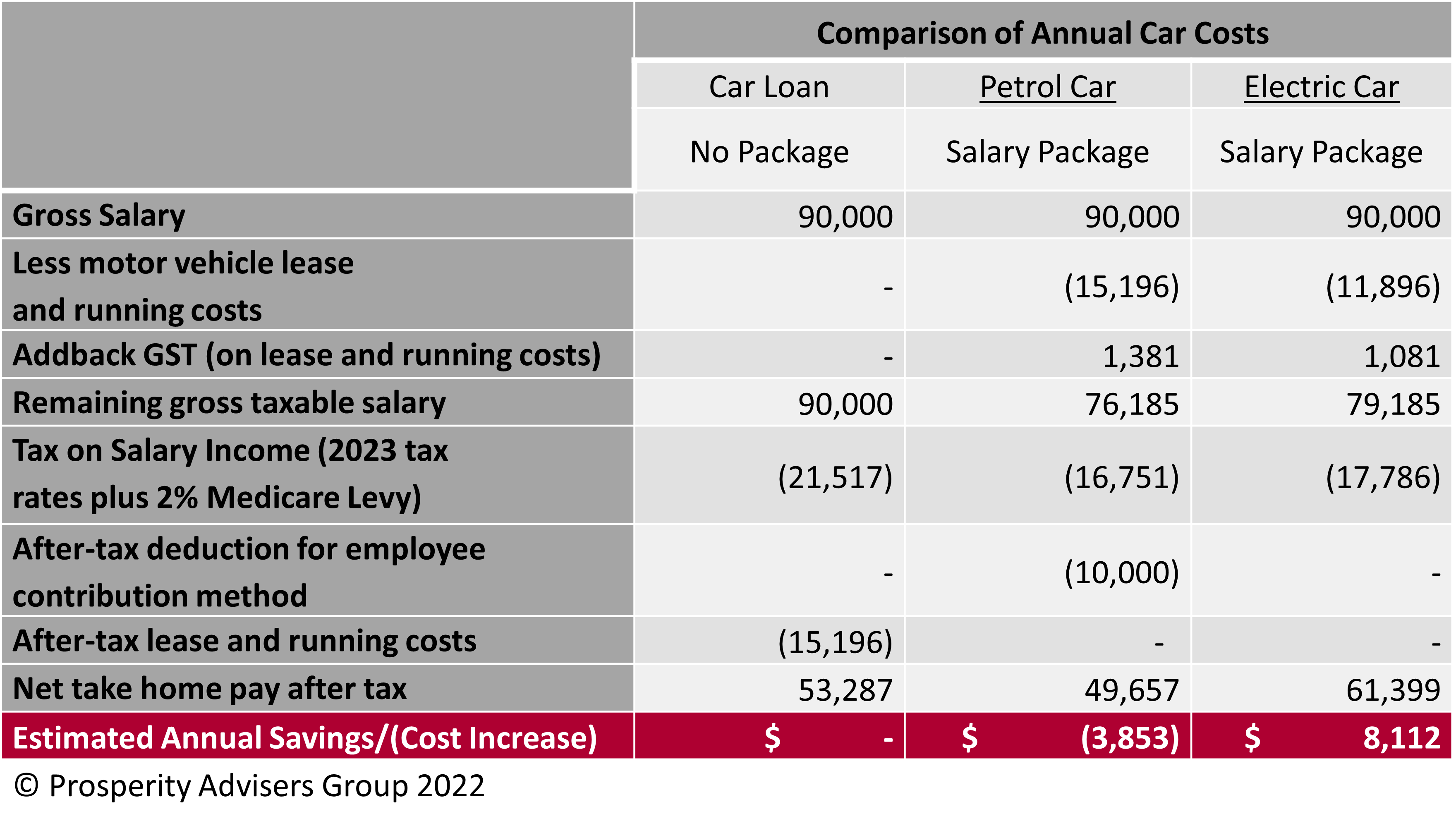

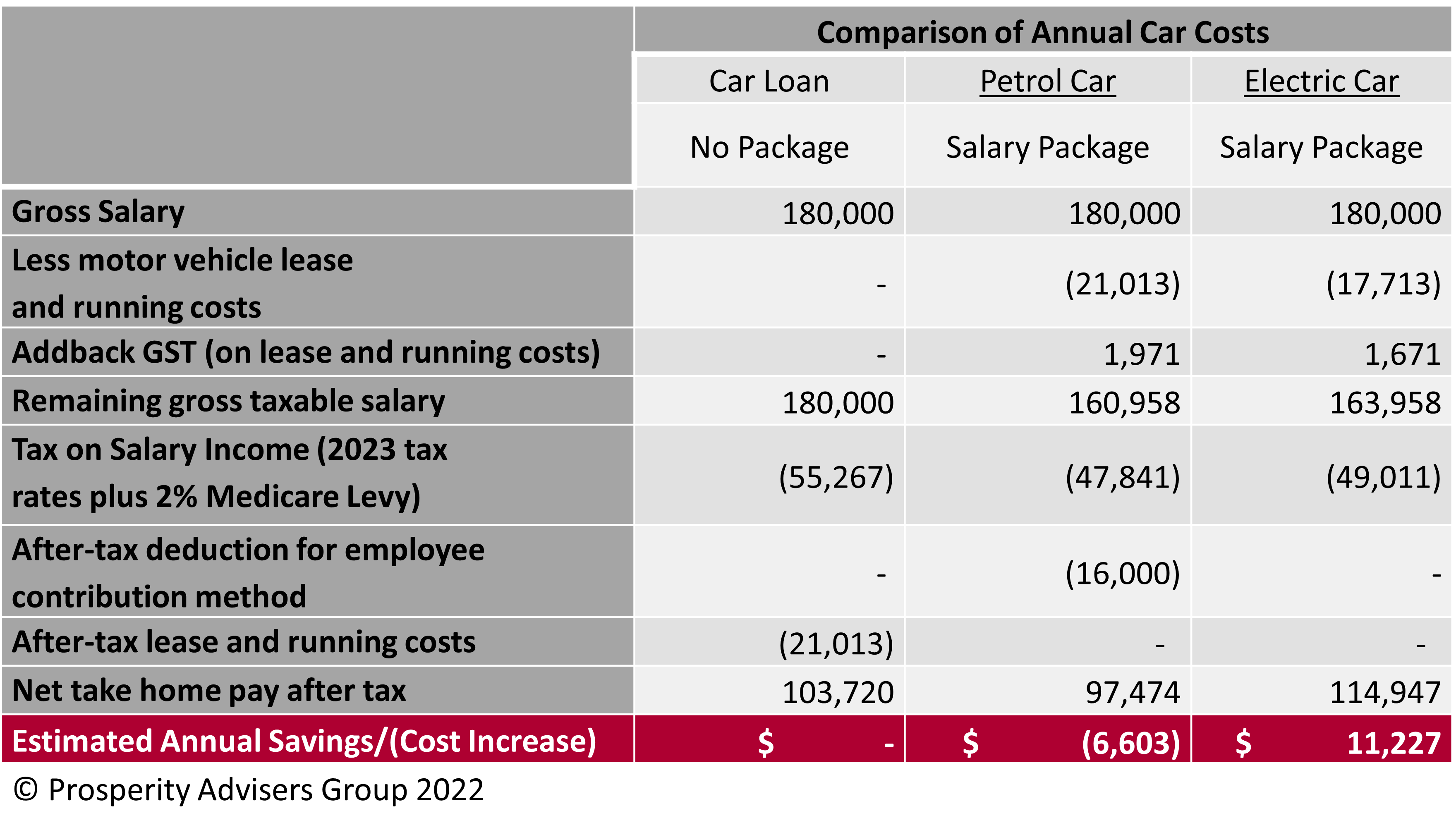

To demonstrate the impact of these changes, consider the following scenarios which highlight the use of a novated leases to purchase vehicles through salary package arrangements.

Scenario 1: Employee on $90,000 Gross Salary, Purchasing a $50,000 Vehicle: Scenario 2: Business owner on $180,000 Gross Salary, Purchasing an $80,000 Vehicle:

Scenario 2: Business owner on $180,000 Gross Salary, Purchasing an $80,000 Vehicle: The following Assumptions were made when preparing calculations for these scenarios.

The following Assumptions were made when preparing calculations for these scenarios.

- Lease term of 60 months with a balloon payment of 28.13%

- Fuel costs of $60/week for Petrol cars.

- Rego costs based on current New South Wales or Queensland rates.

- $1,000 Insurance cost assumed for Petrol cars, $1,200 for Electric

- $600 Estimated repairs and maintenance cost for Petrol cars, $300 for Electric

- FBT Payable based on the 20% statutory formula method is passed onto the employee by the employer as an after-tax deduction under the employee contribution method (ECM)

With the amount of real cash savings over the life of the lease term, you could more than cover the final balloon payment when you opt for an electric car, compared to a petrol car that you need to dip into your savings to pay off, or to refinance and take out another loan over a now second-hand car.

As an employer, it is important to note there will still be a reportable fringe benefit that needs to be assessed on a case-by-case basis for each employee. However as outlined above, there are significant tax savings available through salary packaging these cars.

With the significance of the tax savings on offer, these changes may be something that interests you. Given this, and if you have been considering buying a new car then please reach out to our Salary Packaging and Novated Leasing team to explore some options and discuss what this could mean for you and your business.