In handing down the Federal Budget, the Treasurer, Josh Frydenberg reminded us that COVID-19 is the most severe economic crisis since the Great Depression and that Australia has not been immune.

The economic highlights include:

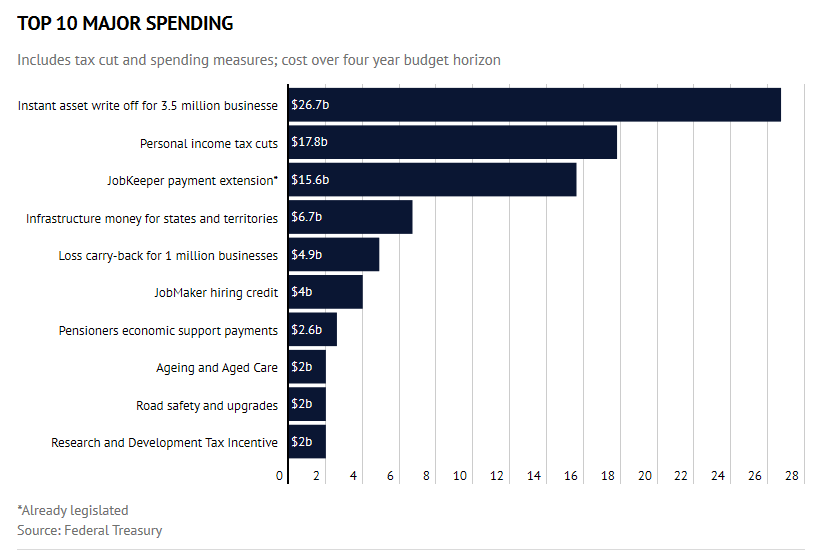

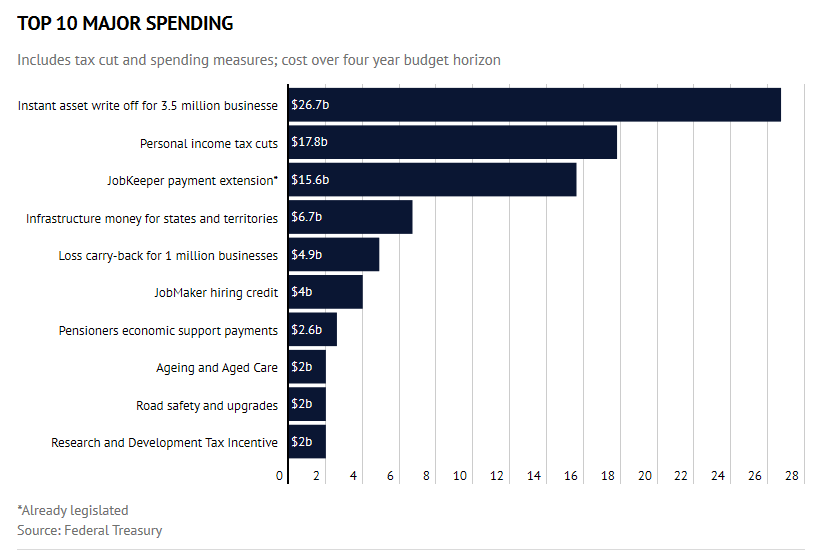

What the Government is spending in this Budget:

![]()

![]()

For Businesses

Encouraging Employment

We are available to discuss your specific circumstances with you and to assist with any decisions you might be considering. Don’t hesitate to get in touch with your Prosperity Adviser today or give us a call on 1800 855 844.

According to Mr Frydenberg, the budget delivered on 6 October is intended to provide us with the journey to rebuild the economy and secure Australia’s future.

- Real GDP set to fall 3.75% this calendar year, then grow 4.25% in 2021.

- Australian Net Debt estimated to be $703 billion by June 2021 and $966 billion by June 2024.

- Unemployment rate is forecast to peak near 8% in the December quarter and expected to stay above 6% until June 2023.

For Individuals

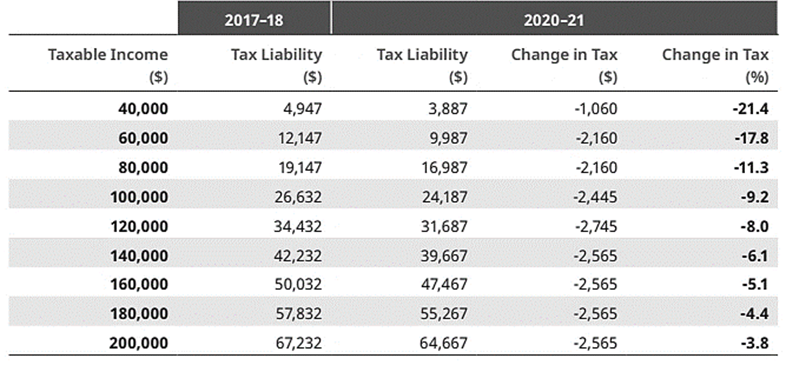

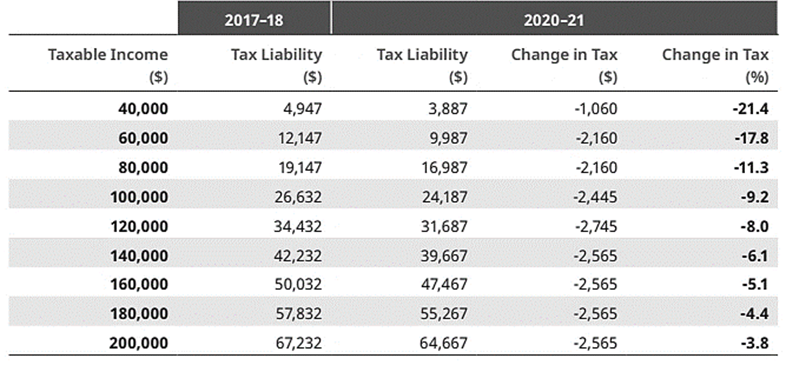

- Personal tax cuts (Stage 2) to be brought forward by two years and backdated to 1 July 2020.

- The top threshold of the 19% personal income tax bracket will increase from $37,000 to $45,000.

- The top threshold of the 32.5% personal income tax bracket will increase from $90,000 to $120,000.

- $1,080 low and middle-income tax offset retained for the 2020-21 financial year.

- Low income tax offset (LITO) will increase from $445 to $700.

- Impact of the Stage 2 tax cuts:

- The instant asset write-off, now referred to as “full expensing”, has been expanded to all businesses with turnover of up to $5 billion until 30 June 2022. This applies to new assets and improvements to existing assets.

- In addition, for small and medium sized businesses (less than $50 million turnover), full expensing is also available for second-hand assets until 30 June 2022.

- Similarly, for businesses with turnover between $50 million and $500 million, full expensing is available for second-hand assets purchased by 31 December 2020 and installed and ready for use by 30 June 2021, capped at $150,000.

- For small businesses (less than $10 million turnover), the balance of the simplified depreciation pool may be expensed in full.

- Temporary loss carry back - corporate tax entities with aggregated turnover of less than $5 billion can apply tax losses from the 2019-20, 2020-21 or 2021-22 income years against previously taxed profits in the 2018-19 or later income years, generating a refundable tax offset in the year in which the losses are incurred.

- Changes to the Research and Development Tax Incentive for businesses:

- Under $20 million turnover, a refundable tax offset of 18.5% above the claimant’s company tax rate. In addition, the proposed cap of $4 million on refunds will not proceed.

- Above $20 million turnover, the R&D intensity tiers have been reduced from 3 to 2, with a deferred start date of 1 July 2021.

- Eligible businesses with turnover under $50 million can access the following concessions:

- Immediately deduct certain start-up and prepaid expenditure from 1 July 2020.

- FBT exemption on car parking and multiple work-related portable electronic devices provided to employees from 1 April 2021.

- Access to the simplified trading stock rules from 1 July 2021.

- A two-year amendment period from 1 July 2021.

- Calculate PAYG Instalments based on GDP adjusted notional tax.

- Settle excise duty and excise-equivalent customs duty monthly.

- Access the simplified accounting method for GST purposes.

- Introduction of the JobMaker Hiring Credit for employing eligible young people. Eligible young people are those aged 16-35 who were on JobSeeker, Youth Allowance or Parenting Payment for at least 1 month in the 3 months prior to hiring. In order to access the scheme employers must increase their overall headcount and the newly hired employees must work at least 20 hours per week. The subsidy rates are as follows:

- $200 per week for people aged 16-29

- $100 per week for people aged 30-35

- FBT exemption for retraining and reskilling redundant or soon to be redundant staff. The retraining and reskilling benefits provided may not be related to their current employment.

Other tax measures

A number of other tax measures were also announced in the Budget, including:- CGT exemption for Granny flat arrangements for older Australians or those with a disability.

- Exemption for Victorian Government business support grants announced on 13 September 2020 (normally assessable).

- Clarifying corporate residency for foreign incorporated companies – resident of Australia only if there is a ‘significant economic connection to Australia’ (core commercial activities and central management and control).

- Additional ATO funding for various projects.