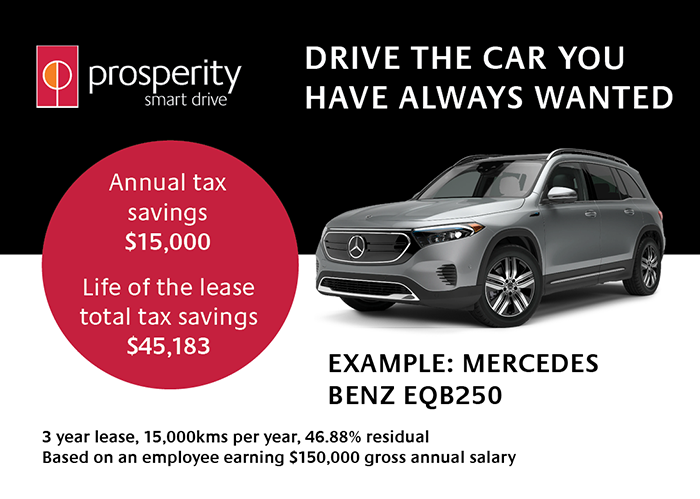

If you were told you could have annual tax savings of up to five figures through a salary packaging arrangement, simply by opting to purchase an electric vehicle (EV), you might think this is just another one of those too good to be true moments. The savings apply even if the vehicle is 100% private use.

This scenario is now the reality for a growing number of Australians, and no matter how you look at it, opting for a novated lease to acquire an EV is the obvious choice for many.

With the introduction of the federal government's recent electric vehicle legislation, eligible vehicles are exempt from FBT (Fringe Benefits Tax), significantly reducing the out-of-pocket costs for owning and operating an EV throughout the vehicle's lifespan.

The EV exemption, which took effect on December 12th, 2022, applies to eligible vehicles purchased new from July 2022 onwards and priced under the fuel-efficient Luxury Car Tax threshold (currently at $89,332).

These changes to the FBT rules have led to a surge of interest in electric vehicles in Australia, which are proving popular with those wishing to embrace a personal travel option that will provide environmental gains for years to come.

On the financial front, these changes can lead to thousands of dollars in tax savings through salary packaging a novated lease where all finance and running costs are exempt from FBT. There is no doubt that electric vehicles are where the market is heading, but is an electric car right for you?

For our client Brendan taking advantage of the EV Discount was a no brainer. The FBT exemption and his novated lease with Prosperity Smart Drive is saving Brendan a whopping total of $37,004 including GST on the purchase price and annual tax savings over a 4-year lease term. Now that’s something to get excited about!

As an employer, it is important to note that salary packaging an FBT exempt electric vehicle will create reportable fringe benefits, and the team at Prosperity review this with each employee.

Aside from the significant tax savings associated with buying an EV through a novated lease, there are further benefits to electric vehicles. Here are a few points to help your thought processes:

- Lower running costs. Although the upfront purchase price of electric vehicles is generally higher than similar internal combustion engines, the lower fuel and simpler scheduled maintenance costs mean drivers will save significant sums over their ownership period. Transport NSW recently published expected savings of up to 70% for fuel and around 40% for maintenance costs, which could mean an additional $1,000 or more in your pocket every year.

- Electric vehicles offer a level of smooth, quiet driving that is not common among petrol and diesel vehicles, while simultaneously offering greater torque for speed off the mark. With many electric vehicles having the batteries underneath the vehicle, a lower centre of gravity provides better handling than many petrol or diesel vehicles.

- Although undeniably, electric vehicles still need to be re-charged off the grid, the reduction in greenhouse emissions and odours has got to be a positive both for now and for future generations. The use of improving and emerging renewable energy sources will continue to reduce the overall greenhouse emissions output for electric vehicle production and their operation.

Whether you are an individual looking to explore the possibilities of electric vehicles and novated leases, or an employer looking for options to improve the financial outcomes for your valued staff members, we’d love to speak with you about how easy and cost effective it can be to give yourself or your team an effective pay rise with novated leases.

To explore the possibilities for yourself, contact the Prosperity Smart Drive Team on 1300 761 388 or email smartdrive@prosperity.com.au.