A surge in young Millennial and Generation Z investors is reshaping the investment landscape, driven by the rise in user-friendly tech-based options. The 2023 ASX Australian Investor Study reveals that these "next generation" investors, aged 18-24, now constitute 9% of Australia's 10.2 million investors, with a staggering 63% entering the market within the last two years. These emerging affluents, the study found, are heavily influenced by social media and environmental, social and governance (ESG) factors, which is reflected in their preference for Exchange-Traded Funds (ETFs) and cryptocurrencies, which collectively make up nearly 65% of individual portfolios.

The Rise of NextGen Financial Advice

This influx of young investors is facilitated by the accessibility offered by modern trading app-based platforms and the role of social media as an educational resource, highlighting more than ever the importance of taking time to research and consider the risks associated with each investment and teaching financial literacy.

Acknowledging the growing interest in financial advice among younger Australians, Prosperity Wealth Advisers is introducing a new financial advice model targeted specifically to their needs. NextGen Financial Advice is an innovative initiative that aims to bridge the gap between traditional financial guidance and a more accessible service tailored to the needs of the younger demographic.

NextGen redefines financial advice by introducing a scaled advice model, specifically designed for young adults embarking on their wealth accumulation journey at a more accessible price point. By addressing the challenges and opportunities unique to students, new graduates and young professionals in their 20s and 30s, NextGen strives to foster financial literacy and empower young individuals to build a secure financial future.

Benefits of Early Financial Advice

- Elevate Your Financial Knowledge and Confidence: By establishing a solid understanding of money management principles, young people are empowered with informed decision-making for proactive financial management throughout life.

- Learn How to Set and Achieve Goals: Collaborate with advisers to create personalised plans for short-term and long-term objectives, gain clarity on realistic timelines and optimal savings strategies for aspirations like homeownership or education.

- Develop Financial Discipline and Strong Saving Habits: Instill discipline in saving, spending and investing from an early age to create a resilient financial foundation for stability and future opportunities.

- Understand Wealth Accumulation and Experience the Power of Compounding: Start early to gain a crucial time advantage for accelerated investment growth and leverage compounding returns for exponential wealth growth over time.

- Secure Your future with Wealth Protection: Setting up personal insurances early can reduce the risk of exclusions or loadings and provides protection against unforeseen health issues, establishing a stable and worry-free financial journey.

Investing Early

History shows us that successful investing is all about patience and discipline rather than playing the market. Time not only decreases risk but increases reward thanks to the power of compound returns. Compounding returns grows wealth exponentially over time, meaning early modest contributions across a diversified portfolio can become a pathway to substantial wealth, making investing accessible and fortifying against market fluctuations.

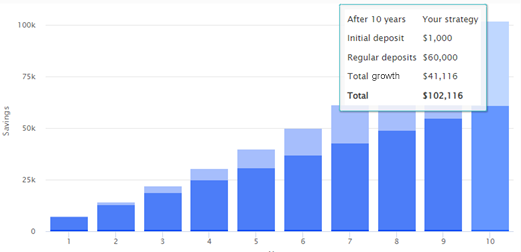

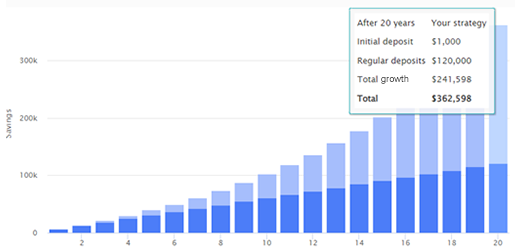

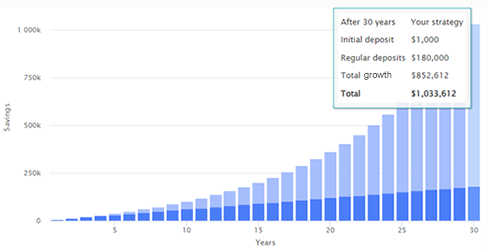

The power of compound returns can be seen in the blow graphs.

An initial $1000 deposit with additional monthly deposits of $500 with an annual net return of 9.5% over 10 years will result in $102,116, including just over $41,000 profit.

Continue this investment for another 10 years with the same monthly deposits and the investment growth earnt jumps to over $241,000, bringing the total to $362,598.

Another 10 years, for a total of 30 years and the total portfolio is now $1,033,612 including over $850,000 of investment growth.

When it comes to compound returns, time literally is money.

Empowering First Home Buyers

Whether it be saving for a first home deposit, reducing (or avoiding) Lenders Mortgage Insurance (LMI), NextGen goes beyond just financial advice. Our Financial Advisers work with the Prosperity Lending Team to empower first home buyers and make dreams a reality at any stage of the journey. This comprehensive approach ensures that clients receive guidance not only in investment strategies but also in navigating the complexities of real estate transactions.

How to Get Started?

Your Financial Future Starts Here! Connect with us today to embark on the journey of financial prosperity for the next generation by speaking to your Principal Adviser or Rocky Johnston at emailing rjohnston@prosperity.com.au.

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).