The Queensland mid-year budget announced on the 16th of December will significantly impact QLD investors who hold properties interstate.

The Palaszczuk government will make changes to the legislation to capture interstate investors by amending the current land tax arrangements to account for the value of land held interstate when assessing taxpayers’ land tax liability.

On the flip side, it is likely to capture QLD investors who already have property investments interstate.

The current position is to count land value in QLD only.

The proposal is to count land value of each individual or entity’s total landholdings over multiple states which increases the amount of land tax paid.

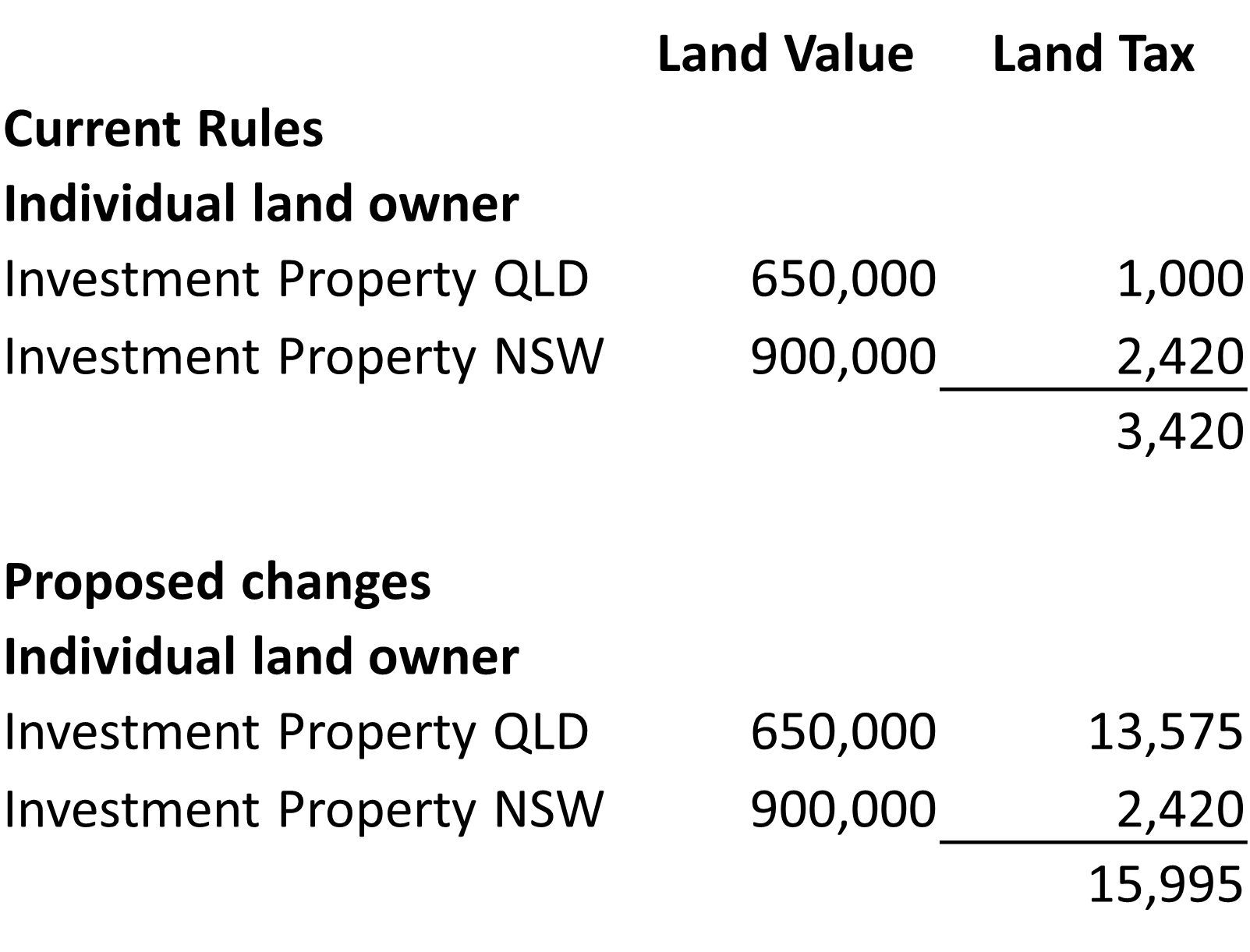

Example

The below calculation is based on the current land tax rates where a QLD investor also owns a property in NSW. The property is owned in their personal name.

This would be a significant increase in land tax payable.

There are important tax planning opportunities and matters to consider with this announcement. The timing of this changes is subject to the passing of appropriate legislative amendments

For more information, please contact your Prosperity Adviser to discuss your future investment plans including the selection of the right taxation structure for your next purchase.