Despite the often negative headlines that accompany any changes to superannuation and the complexity of the system, it remains the most tax-effective means to provide an income stream in retirement.

Superannuation earnings are currently taxed at the concessional rate of 15% in accumulation mode and 0% in pension mode. In retirement, it is possible to have up to $1.9m in the pension phase, paying no tax on income and gains within the fund and providing a non-assessable income stream. For a couple, that is up to $3.8m combined.

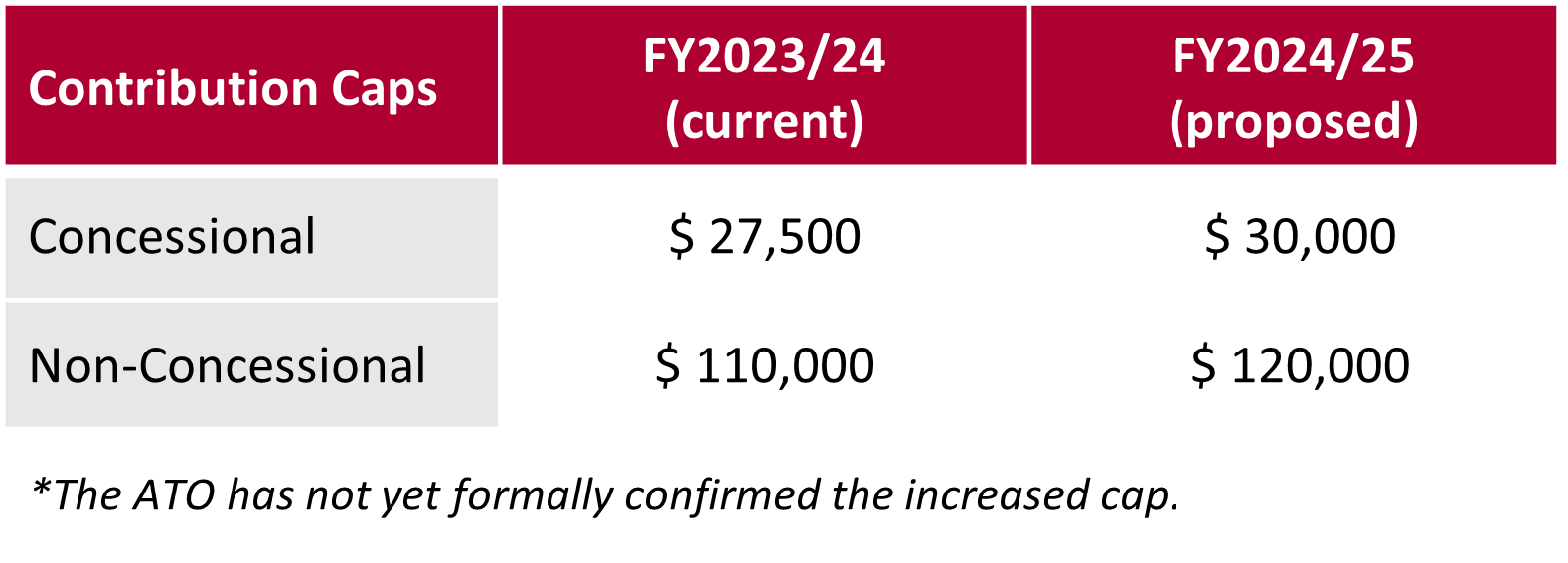

The annual amounts we can contribute to superannuation are restricted by contribution caps, which are periodically indexed.

The most common ways to transfer money into super are concessional contributions (“CCs”), comprised of employer and personal deductible contributions and non-concessional contributions (“NCCs”), contributions made using money we have already paid tax on.

The annual concessional contribution and non-concessional contribution caps are due to increase to $30,000 and $120,000, respectively, from 1 July 2024 (having last changed in July 2021).

This proposed change has an impact and provides opportunities on a number of superannuation contribution strategies, several of which are discussed below.

Bring forward contribution

Under current rules, you can opt to “bring forward” two future NCC contribution cap allowances. Effectively allowing you to contribute three tax years at once. You are then unable to make further NCCs until those future years have passed. With the proposed increase in caps, this means that the current maximum forward contribution in 2023/24 is $330,000, which from July (2024/25 tax year) increases to $360,000. The timing of these payments needs careful consideration.

Total Super Balance

The ability to make NCCs is only available where your Total Super Balance (“TSB”) is under the TSB cap. The TSB is the total of all your super account balances (*) across all policies. This is currently $1,900,000.Additionally, if your balance is close to this cap (in excess of $1,680,000), this can limit your ability to use the bring-forward NCCs.With the proposed increase in the NCC cap, this TSB threshold will reduce from $1,680,000 to $1,660,000 from 1 July 2024).

* A separate calculation is used to determine the value of defined-benefit pensions.

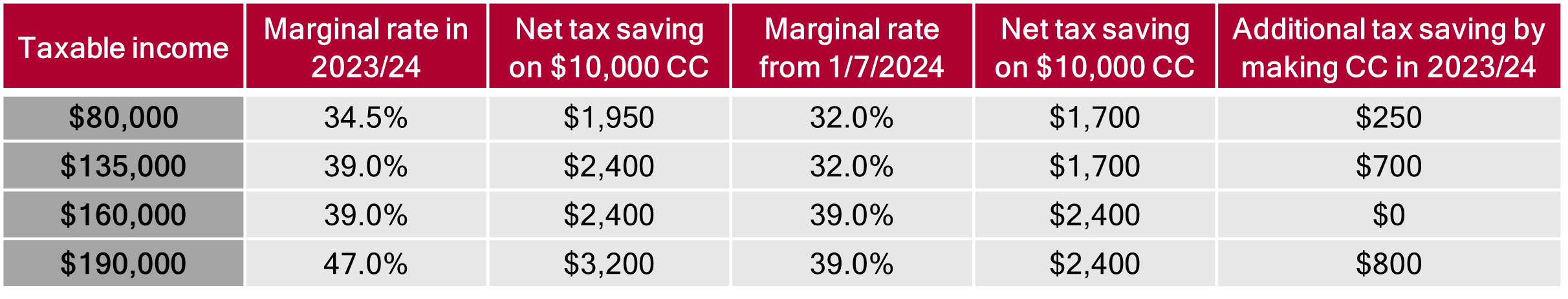

Changing tax benefits of personal deductible or salary sacrifice contributions.

Should the government pass the proposed stage 3 tax cuts, this will have an impact on the tax saving of personal deductible contributions or salary sacrifice. For most middle and high-income earners, their personal tax rate will reduce. A reduced personal tax rate reduces the overall tax saving.

For those considering a personal contribution this year, you should consider if this is better made in the 2023/24 or 2024/25 tax year.

Tax savings of voluntary $10,000 CC in 2023/24 vs 2024/25

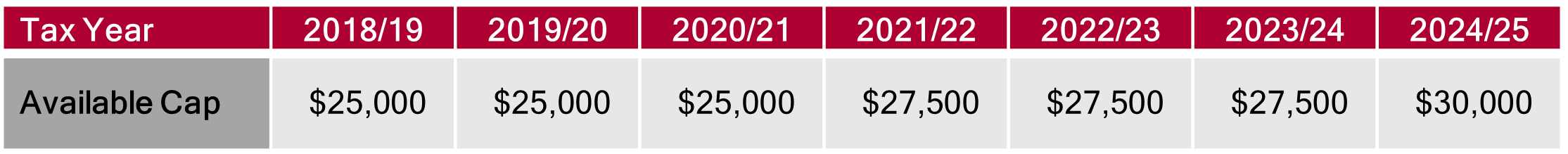

Unused concessional contributions

Currently, individuals with a Total Super Balance under $500,000 (as at the previous 30 June) can use previously unused concessional contributions from the last five tax years. This can be a very valuable means to either simply boost your super balance tax effectively or offer the potential to help reduce the tax from a capital gains tax event.

As this catch-up is only available for the preceding five tax years and uses the oldest tax year first, from 1 July 2024, the available amount from 2018/19 will be lost.

Contributions up to age 75

Individuals aged less than 75 may make superannuation NCCs regardless of working status. This offers valuable additional time to top-up your super and convert this to a non-assessable (tax-free) income stream. It also offers opportunities such as:

- Maximizing the total balance a couple can have in superannuation.

- Equalising super balances (ie., where one client may be impacted by the TSB, and the other has a lower balance).

- Reducing potential tax payable on superannuation death benefits through a recontribution strategy.

It’s important to note, that the noted changes to super contribution caps and stage three tax cuts remain proposed and are not as yet law.

Other considerations

- An increased concessional cap could increase the opportunity for spouse contribution splitting.

- The impact of your current contribution strategy if you intend to make future use of a downsizer contribution/or small business tax relief contributions, considering the proposed additional tax on balances over $3,000,000.

Given the continually changing rules relating to Superannuation and the recent proposal to apply an additional tax to individual balances over $3m, there is no better time to review your superannuation strategy. For more information or to review your superannuation strategy, please contact Prosperity Financial Adviser Graham Southgate at gsouthgate@prosperity.com.au or your principal adviser.

This communication contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).