In this article we discuss the role of active investing. In particular, the following key areas:

- The power of accumulation;

- Why not all returns are equal, even if they look the same; and

- Matching your investments to your goals.

Apart from the investment we make in our careers, practices and homes, the most significant investment we make is for our future and our goals. Whether those are short term goals, like an overseas holiday, or longer term goals, like retirement.

The power of accumulation

The most successful way to build your worth is to accumulate it, and the most successful way to accumulate it is to start early and save often.

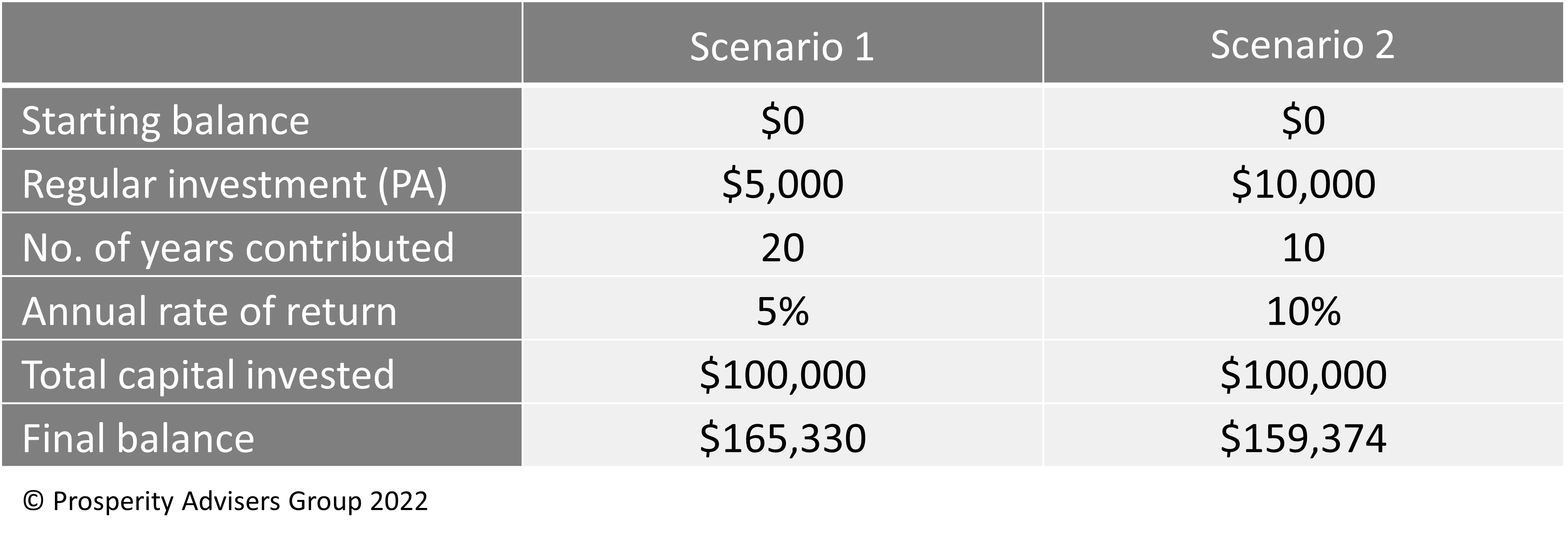

Example:

*In considering the above example, we have ignored any investment risk. The above scenarios are a model only and not predictive of any return on your investment.

*In considering the above example, we have ignored any investment risk. The above scenarios are a model only and not predictive of any return on your investment.

In this example, despite the same amount of capital being invested, ie $100,000, and despite the return on the second scenario being double, the amount the investor has at the end of the period is better on the slower and lower earning portfolio. This is due to the power of regularly accumulating capital and the power of compound earnings on that capital.

Why not all returns are equal, even if they look the same

The press regularly reports on investment returns in terms of dollars and percentages, but what attracts much less reporting is investment risk, despite it being impossible to make a valid judgment on returns without considering risk.

There are many risks in accumulating and building wealth, from concentration risk to counterparty risk and even the risk of you outliving the capital. Another risk to consider is investment volatility, or the variance from the return that you might expect from your investment.

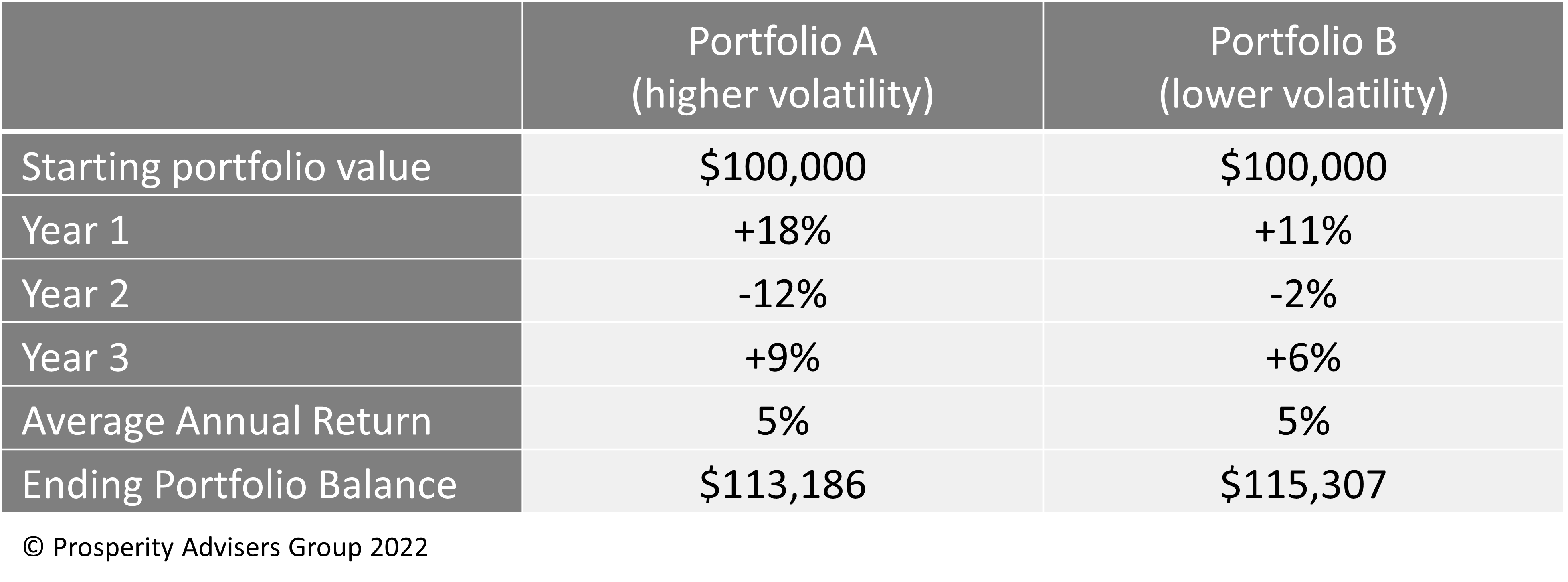

Example:

*The above scenarios are a model only and not predictive of any return on your investment.

*The above scenarios are a model only and not predictive of any return on your investment.

In this example, the returns are identical, at least in an average sense, over the three year period, however the returns in Portfolio B are much less volatile that the returns in Portfolio A. This means the highs and the lows in the various years in Portfolio B are constrained around a much tighter bandwidth than those in Portfolio A.

Portfolio A is symbolic of an index approach, also known as passive investing, where we simply take the index of whatever market it is we’re trying to invest in, whereas Portfolio B is symbolic of a successful active management approach, where we select certain sectors and certain stocks and have higher or lower weightings to those sectors and stocks, with the idea of trying to remove those variabilities or volatilities.

Volatility is important

Even though the returns are identical in each portfolio, the lower value portfolio produces a better dollar return over the three year period. It follows that it is important to consider volatility when measuring against return, even when looking at a return of +18% compared with +11%, as in the first year of the above scenario. Managing downside risk, even at the expense of giving away some of the upside, usually pays off in the long run.

Matching your investments to your goals

Using the above example, if your investment goal is only one year away, then neither of those portfolios is suitable. Similarly, for longer term investing, the vagaries of the share market are not as important over the period of the investment. A higher return, with some constrained volatility, would usually give a better result in the long run. We can expect and cope with some volatility along the way.

As a general rule, cash and shorter term deposits are more suited to short term goals, and share market or growth investments are more suited to longer term goals. It’s also important to consider your investment risk temperament. Your Prosperity Adviser can work through the various risk profiles and determine which is the most appropriate for you.

In summary, for effective accumulation for wealth, start early and save regularly. When considering your investment returns, always look at the volatility of those returns, not just the absolute figure. Finally, match your investment to the goals for which you are investing for. It’s much more important to have access to the capital when you need it, than getting a better return on that capital.

If you have any questions regarding the above, contact Director and Financial Adviser, Hamish Landreth at hlandreth@prosperity.com.au. Alternatively you may contact your Principal Adviser on 1300 795 515 to discuss.

This communication contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).